I started FX and I’m already in the red!

I’ve been burning through my cash after I quit my job and I have to do something about it quick.

As part of my cash-flow improvement project, I laid hands on the forbidden fruit, FX.

I am a total newbie to FX

A lot of my colleagues at my former job were into FX.

This was partly because stock investments were restricted by the company.

I was more of a micro person (focusing on individual businesses) than a macro guy (analyzing the economy as a whole) so I never got into FX.

Not until now.

I am going to hit the jackpot with FX!

Why FX? Comparison with stock investing

I’m going to summarize the main differences I felt between FX and regular stock investing after two days of playing around.

- With FX, you’re leveraged 25 times from the start (with DMM FX) so the gains and losses are amplified compared to regular stock investing

- With FX, you can easily take both a Long position and a Short position

- The Bid – Ask spread is relatively insignificant compared to transaction fees for stock investments and that leads to more frequent trading

With FX, you’re leveraged 10 times from the start so the gains and losses are amplified compared to regular stock investing

When you’re leveraged, that means you’re gambling with borrowed money.

Supposed you bought 40,000 JPY worth of dollars.

If the dollar goes up by 10% to the yen, your yen based position will increase by 10% to 44,000 JPY.

When you’re leveraged 25 times, when the dollar goes up 10% to the yen, your yen based position increases by 250% to 100,000 JPY.

It’s the equivalent of transacting with 1,000,000 JPY which is 25 times the initial investment of 40,000 JPY.

You’re borrowing 960,000 JPY and using that to gamble.

With leveraging, you can aim for a higher return with less but your losses are going to get amplified in the same.

Obviously, risk is higher.

With FX, you can easily take both a Long position and a Short position

With stock investing, you can short stocks to take a short position.

But you’ll have to apply for this function to be added to your investment account.

With FX, your can easily take a short position from the start so you can go back and forth long and short positions with ease.

In other words, with stock, you had to wait until the price rose and then you would sell for a gain.

With FX, you can aim to make a profit on both upswings and downswings.

The important thing here is that you can try to profit.

It’ not necessary going to make it easier.

Bid – Ask spread is relatively insignificant compared to transaction fees for stock investments and that leads to more frequent trading

With stock investing, you’re charged a transaction fee of a few hundred yen every time you transact.

Those fees can add up and eat through your gains with frequent transactions.

With FX, the transaction cost is a fraction of what you pay for stocks.

With most FX accounts, the transaction fees are included in the Bid-Ask spread.

You don’t even notice it because we’re talking about something like 0.006 yen.

I found myself buying and selling by the second to gain a few yen here.

I wouldn’t do this with stocks because of the transaction cost.

Summary

Well, those were my thoughts after two days of FX.

- The volatility in gains and losses are amplified compared to stocks (leverage),

- more opportunities to take a profit (long and short positions) and

- being able to transact frequently (lower transaction cost)

make FX more game-like compared to stocks.

I found that to be the secret of FX’s popularity.

How do I start FX?

Get a FX account, transfer funds. That’s it.

I had to first get a FX account which is what I did.

There are tons of accounts that you can choose from.

They’re mostly the same so just go with a company that you’ve heard of before.

I chose DMM.com FX.

It’s well known and they were doing a 20,000 yen cash back campaign so that’s why I went with DMM FX.

I’ve been using it on both the PC and iPhone with no problems.

The application is easily done through the web.

I remember having to send in some paper documents when I set up my brokerage account for stocks.

I didn’t have to do any of that for FX.

After you’re done with the application, DMM will send you some documents in the mail.

You’ll find your account number and password in the documents so use that to login to your account.

The one other thing you have to do before you start trading is to transfer funds to your FX account.

There is a special bank account dedicated just for you to which you can transfer funds.

It takes no more than 30 minutes for the transfer to be reflected in your FX account during business hours.

How much should you initially transfer?

You can start trading Yen for USD with about 50,000 JPY.

But because of the maintenance margin requirement, I suggest you transfer at least 100,000 JPY.

You’ll have to keep a certain level of maintenance margin or your position could be automatically liquidated when your unrecognized losses build up.

So, am I making money with FX?

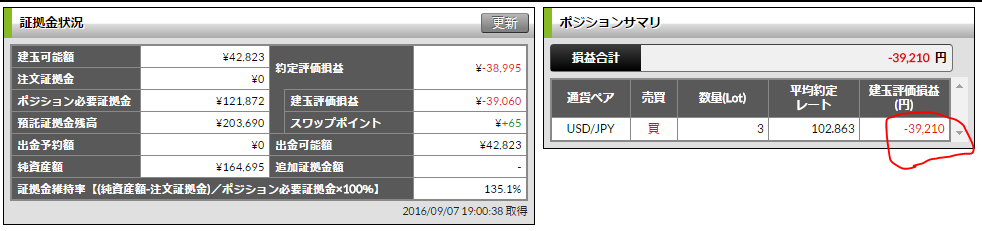

Sadly, I’m already in the red

This was my strategy.

The US wants to raise interest rates => September rate hike => Japan is still in ultra low interest mode => jack pot!!

In the mid-term I’m pretty sure this is how it’ll work out.

However, just as a I took a long position buying dollar, the lower than expected non-manufacturing report came out and the yen spiked against the dollar.

The jobs report that came out last week was also bearish so that’s lowered the expectation for a September rate hike.

As a result, in a matter of hours, I lost 20% of my initial principle and my loss is at 39,210 JPY.

I am expecting a rate hike at least by the end of the year so I’m going to hold on to this position!

I’ll keep you posted with my performance!![]()

Previous Post

Previous Post Next Post

Next Post