What to do with remaining PTO, Use up vs Buy back

Buy back could have its advantages

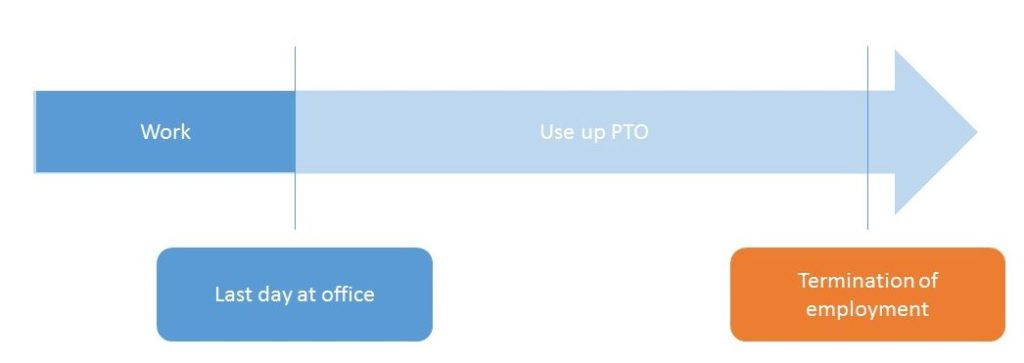

When you finally decide to leave the company, you will have to decide when that last day is going to be.

The “best practice” at my former company was to set the termination date after busy season (in my case end of June) and take the month of May off, using up your PTO (paid time off).

I’m pretty sure it’s similar at other companies as well.

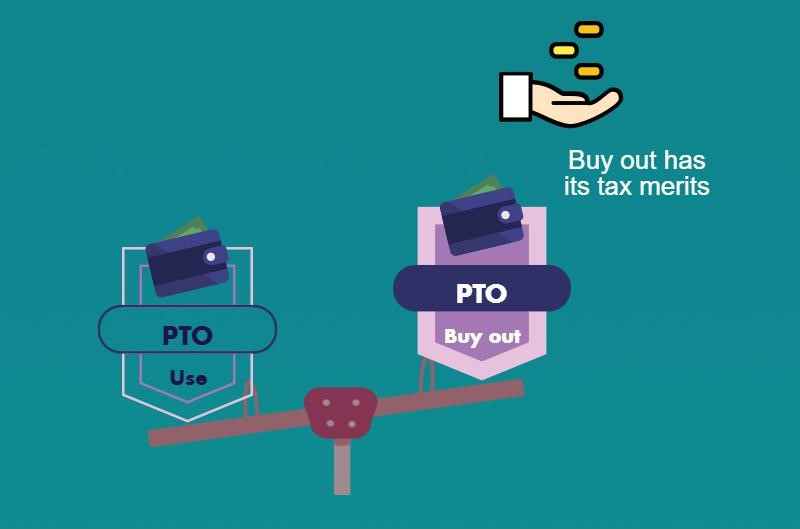

If your company is offering to buy back your unused PTO, you might be wondering which is more advantageous.

Use up PTO, or have the company pay them out.

In my case:

- The company was offering to buy back unused PTO at a rate equal to my pay check (i.e. no discount)

- I had no plans to start working (so I didn’t have to worry about having a “blank period” in my resume. This is something that companies look for when they hire in Japan)

- I wanted to leave the office with grace, making the impression that I gave it my all till the last day (hey, being strategic isn’t a bad thing)

So I decided to have my PTO paid out.

If you’re in a similar situation, having the company buy back your PTO could be a better option monetary wise.

As always, it has to do with taxes

If you decide to use up your PTO, your PTO is going to be paid out to you as normal salary income.

On the other hand, if the company buys it back, it’s usually paid out as retirement income.

Salary income and retirement income are two different sources of income under tax laws and they are taxed differently.

The important thing here is that retirement income gets better treatment!

Your salary income is taxed with income tax + inhabitant tax + social security.

The tax rate is graduated, meaning that the more you earn, the more tax you pay.

Think ballpark of a 15-30% tax rate.

It’s quite a lot, depending on where you come from.

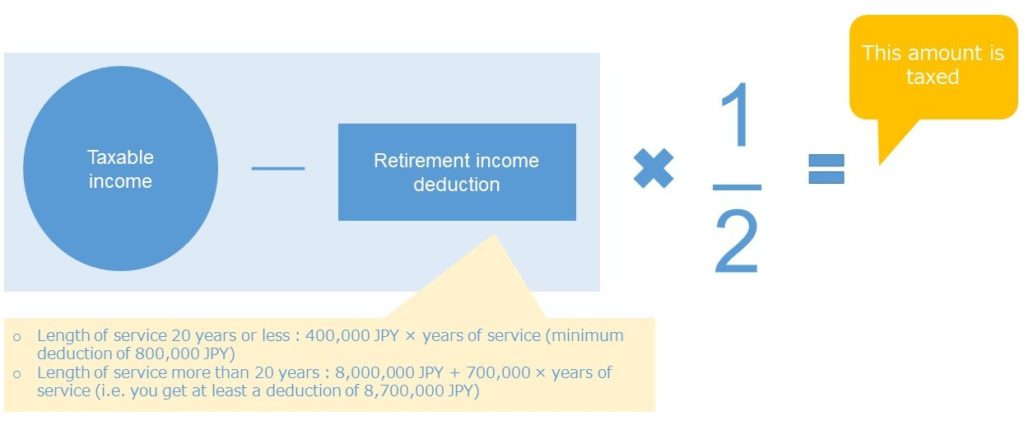

On the other hand, you get a deduction on your retirement income which is going to bump your taxable income down, sometimes even to zero.

You also don’t have to pay social security on your retirement income.

You can have a look at the details at the NTA’s website. Sorry it’s in Japanese!

Don’t worry I broke it down for you below.

What you can take away from this is

- if you’ve worked more than 20 years at your company, you’re not going to get taxed on your retirement income unless it exceeds 8.7 MJPY.

- even if you haven’t worked that long, depending on your retirement income and the years in service, you won’t get taxed on your retirement income.

My severance pay was about 2.5 MJPY and my PTO pay out was around 0.5 MJPY which totaled a retirement income of 3 MJPY.

My service period was 10 years (actually 9.5 years but you round up) so my retirement deduction was 0.4 MJPY x 10 years = 4 MJPY.

The deduction exceeded the retirement income so no tax owed.

That led to a tax savings of 100,000 JPY!!

Things to watch out for

It worked out OK in my case but I wrote down some caution points for you below:

- Make sure your company has a PTO buy-back plan (it’s not mandatory for the company to buy back PTO)

- If your company does offer to buy back PTO, make sure the rate is not discounted compared to your pay check. The tax break isn’t going to mean much if the company is paying out the PTO at a heavy discount

- Make sure that the company is paying out the PTO as retirement income

Well that’s it!

One last thing to think about is; if you’re going to start working at a new company right away, it might be better to use up that PTO and take some time off to refresh.

That time off is going to be “priceless”!!

Previous Post

Previous Post Next Post

Next Post