Applying for non-employment insurance in Japan

I wrote in another post that you should spend the first week after you quit your job, catching up on recent developments in the IT service area.

What to do after that?

Yup, you should apply for non-employment insurance.

To do this, you’ll have to get some documents from your former employer (mine was mailed to me).

It usually takes some time for them to send it to you so you should go and apply in the second week after you quit, assuming that you get those documents of course.

It was the first time for me to apply so I did a bit of researching.

I’m gonna share that with you today.

What is non-employment insurance?

It’s commonly referred to as “sitsugyou hoken” in Japan.

Some people cal it unemployment benefits or compensation but the naming isn’t important.

As part of Japan’s social security program, if you, the employee, become unemployed, you will receive support payments until you find a new job.

Nice, but where does the money come from?

The premiums are withheld from the employees paycheck, so you paid for it!

Who can apply for non-employment insurance?

Put simply, a person who has paid employment insurance premiums for 12 months or more during the past two years is eligible

Remember, this is withheld from your paycheck automatically, so if you’ve worked over a year full time, chances are you’re eligible.

If you’ve worked part time, you could be eligible depending on the hours and number of days you worked so you should definitely look into it.

There’s also special treatment for people who got fired or lost their job due to bankruptcy (of their employer) so you should look into it if this is the case.

On top of that, the requirement is that you have to be in the status of “unemployment”.

What that means is:

You have the ability to work and are actively seeking for work but can’t find work.

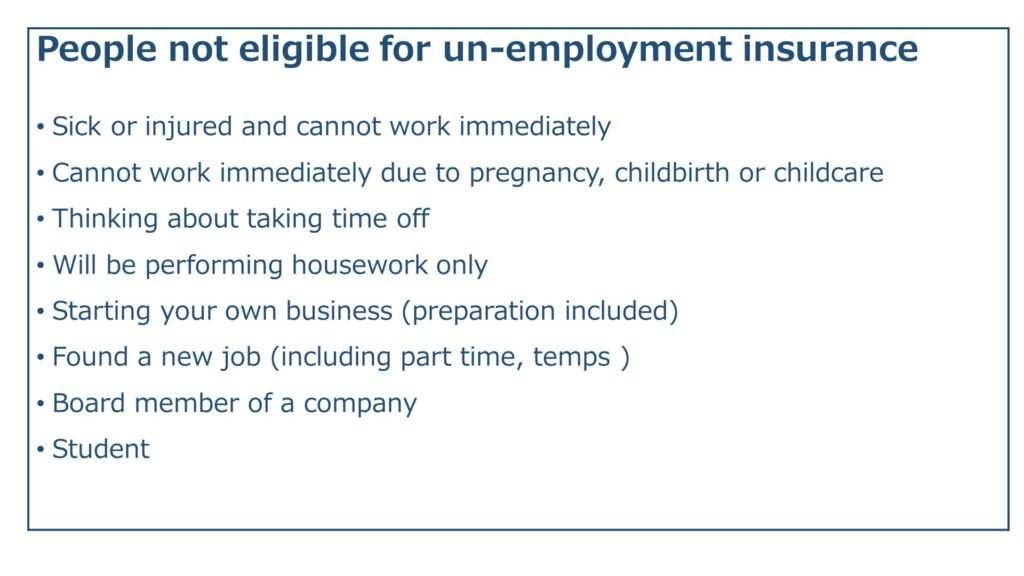

Therefore, you won’t be eligible in the cases below:

Watch out if you’re thinking of starting your own business.

One note of caution, the rules, as with all social security benefits, are very detailed.

You can probably Google it and all but it is really convoluted so my suggestion is to go to the nearest “Hello Work” (Employment Service Center) or call them up.

I did a quick search and it looks like they have a center in Shinjuku for foreigners.

In my personal experience, they are usually very kind and helpful!

How much am I going to get?

That’s what’s important right?

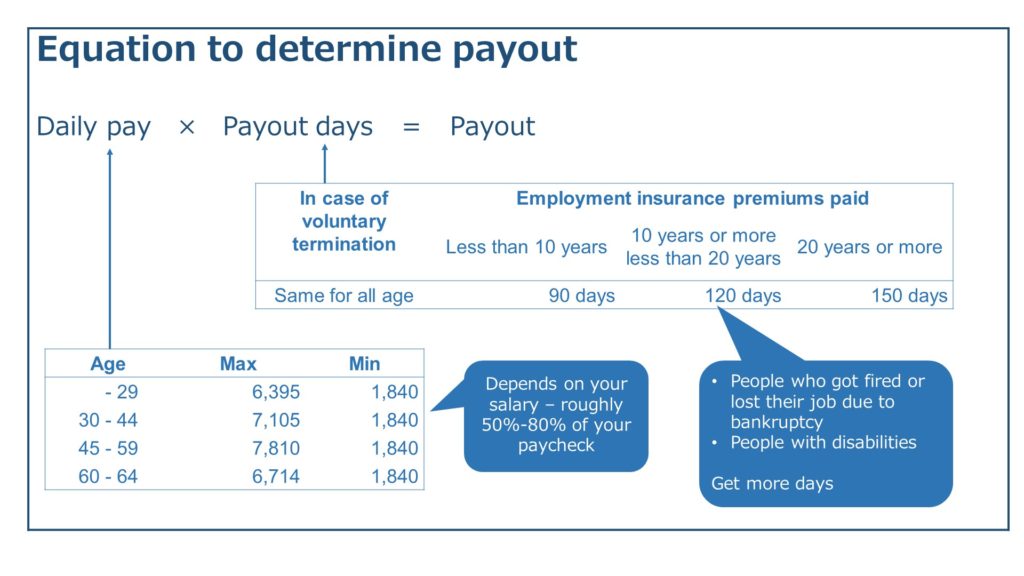

The payout is calculated according the following equation (for voluntary termination):

The payout will depend on your paycheck but you can get a ball park figure from the equation.

For example, at a minimum, you can get 165,600 yen (1,840 x 90 = 165,600).

In my case, my age bracket was 30-44, my daily pay was maxed out at 7,105 yen, and the period I paid employment insurance premiums was less than 10 years so:

7,105 x 90 = 639,450 yen is what I will get.

Keep in mind, the payout is not taxed so I’m going to be receiving 213,150 yen a month, over a period of 90 days.

That is less than one-third of my former paycheck but its going to pay the rent!

So is the payout going to be paid to you immediately after you quit your job?

Unfortunately, that may not be the case.

When can I receive the payout?

For voluntary termination, there is a waiting period of three months

The actual payment schedule is a little tricky, but basically in case of voluntary termination, there is a waiting period of three months.

Once that time has lapsed, your will receive the payout on a monthly basis.

In my case, I quit in June so I won’t be able to receive anything until September.

I’ll be receiving the payout in October, November and December.

This is actually painful for me!!

If you’re depending on non-employment insurance, be sure to save up enough to last you at least three months!!

If you were terminated or lost your job due to bankruptcy (of the employer), there’s no waiting period so no need to worry about that.

What if I start working at a different company while receiving my payout?

You won’t be able to receive the total remaining amount, but you’ll be able to receive it as as an allowance.

It’ll be about 50% of what you were entitled to but better than nothing right?

What’s more important is that you found your new job and so congrats to that!

So what do I have to do to apply?

All applications will be done at your nearest “Hello Work”.

Once you get your documents ready, I recommend going ASAP.

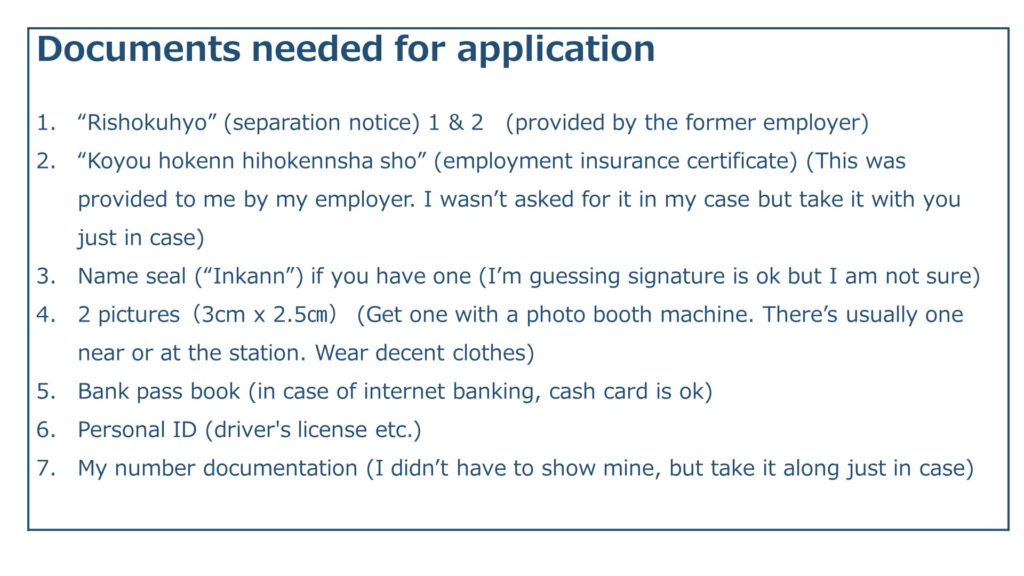

The documents you will be needing are:

I know it’s a pain to go but once you’re there, the paper work isn’t that bad.

They are less crowded in the morning, is at least what I heard.

Wrap up

The paper work isn’t that bad so get it done ASAP!!

Just an FYI, I looked at this website when I was researching so it might come in handy (it’s in Japanese though).

Where am I at with this?

I’ve already finished my application so I’m waiting to get my unemployment status checked in October and finally, I’ll be able to receive October’s payout.

I’ll post that experience as well so stay tuned!

Previous Post

Previous Post Next Post

Next Post